richmond property tax rate 2021

This year the city chose to select the compensating rate for the 2021 rates. Tax bills are mailed out on July 1st and December 1st and are due on September.

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

Manage Your Tax Account.

. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Property taxes are billed in October of each year but they do not become delinquent until Feb. RICHMOND CITY OF TAX.

Tax District 001 Urban 339240. Richmond Hill - 27 per cent of. The November payment is for July 1st through December 31st and the.

The residential tax bill is divided as follows. Property Taxes AND Flat Rate Annual Utilities. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate.

Paying Your Property Taxes. Richmond Taxes City of. The rates of several taxing authorities usually combine to make up your total tax bill.

Be Your Own Property Detective. See Property Records Tax Titles Owner Info More. 2022 Tax Rates.

Search Any Address 2. The new assessments will be used to calculate tax bills mailed to city property owners next year. Car Tax Credit -PPTR.

View Property Appraisals Deeds Structural Details for Any Address in Richmond. Taxes are payable on November 10th 1st half and May 10th 2nd half. Province of BCs Tax Deferment.

Richmond Hill accounts for only about a quarter of your tax bill. Understanding Your Tax Bill. The fiscal year 2021 tax rates are.

View Historic Tax Rates. The City Assessor determines the FMV of over 70000 real property parcels each year. The tax year is July 1st through June 30th.

These agencies provide their required tax rates and the City collects the taxes on their behalf. Real property consists of land buildings and. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Home Services About Richmond Departments. For information and inquiries regarding amounts levied by other taxing authorities.

NO -NEW-REVENUE TAX RATE 0670300 per 100 VOTER -APPROVAL TAX RATE 0630392 per 100 DE MINIMIS RATE 0745750 per 100 The no-new-revenue tax rate is the tax rate for the. Search For Title Tax Pre-Foreclosure Info Today. Due Dates and Penalties for Property Tax.

The rates will be adjusted for 163 cents on each 100 of personal property and 134 cents on. Ad Public Richmond Property Records Can Reveal Mortgages Taxes Liens and Much More. Millage Rates 2021 Net Millage Rates are as follows.

It is estimated that by freezing the rate the city will provide Richmonders more than 8. 1 of the next year. How are residential property taxes divided.

The tax rate for FY 2021-2022 is 380000 cents per 100 assessed value.

Many Left Frustrated As Personal Property Tax Bills Increase

About Your Tax Bill City Of Richmond Hill

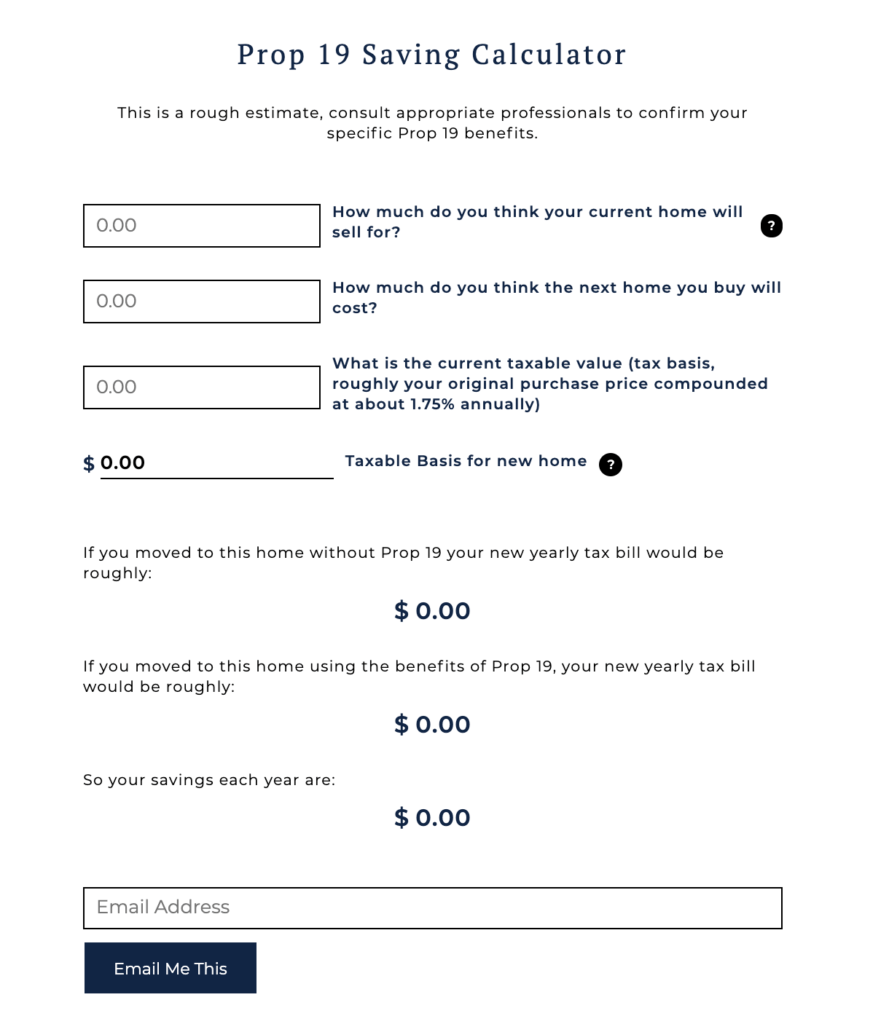

Pros Cons Of Prop 19 Property Tax Portability

Fm 1464 West Airport Rd Richmond Tx 77407 Loopnet

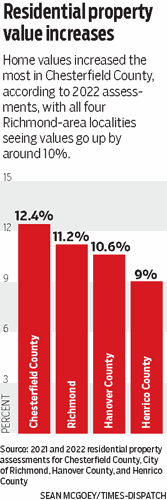

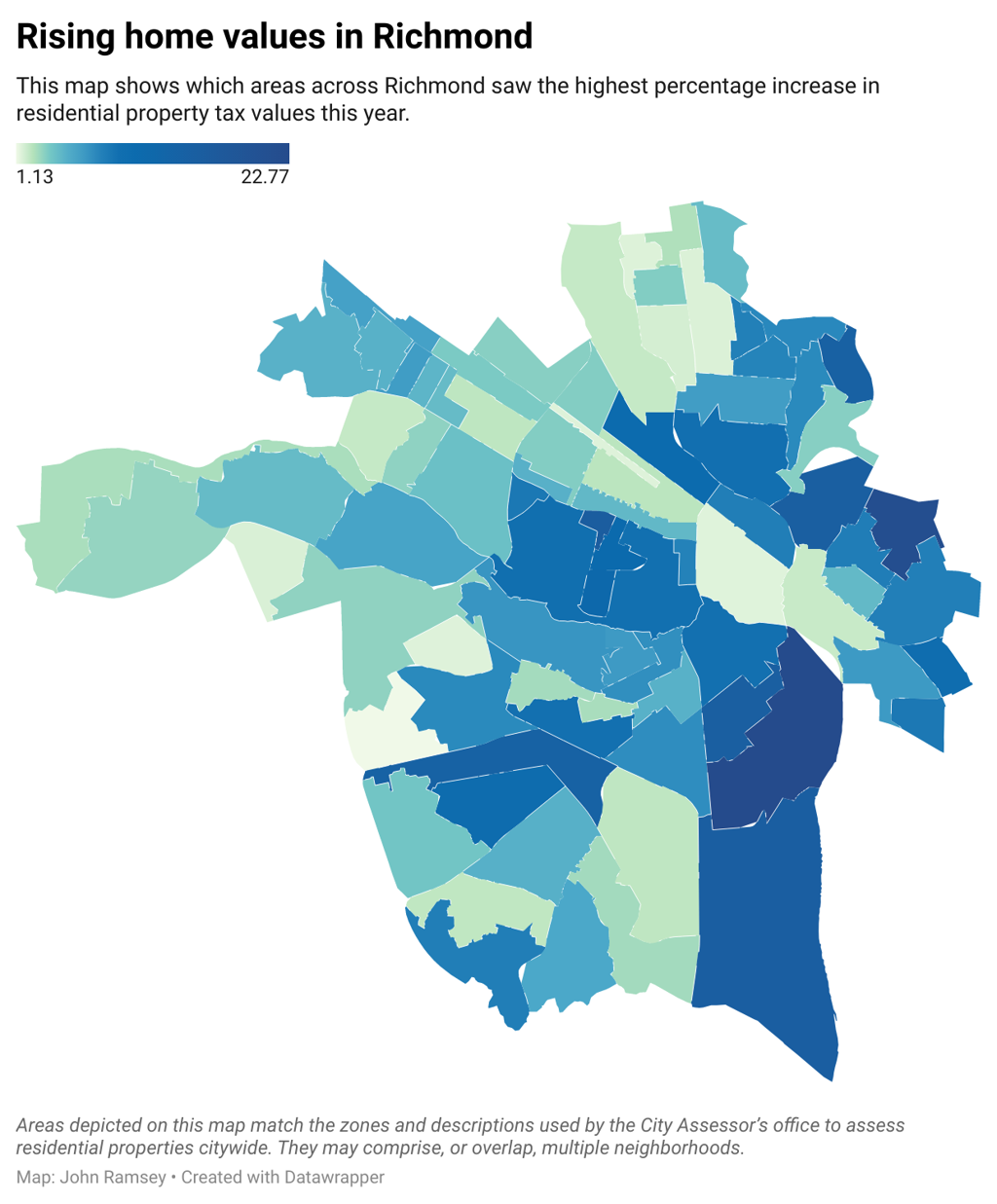

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

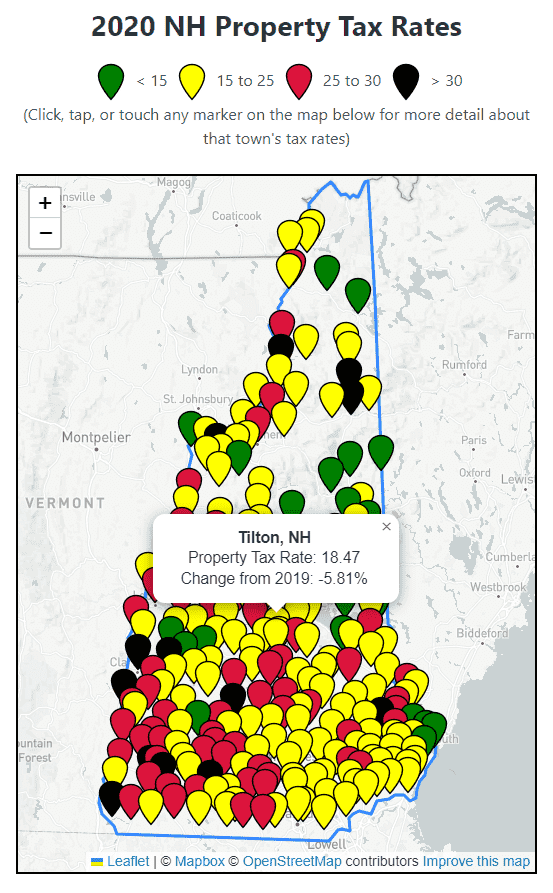

2020 New Hampshire Property Tax Rates Nh Town Property Taxes

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

Richmond Free Press Freepressrva Twitter

Richmond Va Housing Market Prices Trends Forecast 2022 2023

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Where Do People Pay The Most In Property Taxes

Property Tax Rates Williamson County Tn Official Site

With A Steep Property Tax Hike Looming Richmond Officials Weigh Shifting Some Of The Burden To Second Home Owners Central Berkshires Berkshireeagle Com

Newton City Council Sets 2022 Property Tax Rates Newton Ma Patch

Property Taxes Madison County Sheriff S Office Kentucky

:format(webp)/https://www.thestar.com/content/dam/localcommunities/richmond_hill_liberal/news/2021/12/12/richmond-hill-council-delivers-second-consecutive-property-tax-freeze/10536073_Budget-2022-Budget-Graphic-5x2-P490-HighRez.jpg)

Richmond Hill Council Delivers Second Consecutive Property Tax Freeze The Star

Ontario Cities With The Highest And Lowest Property Tax Rates Canada Info

2022 Massachusetts Property Tax Rates Ma Town Property Taxes