raleigh nc vehicle sales tax

Sales and Use Tax Withholding Tax Corporate Income Franchise Tax. The north carolina nc state sales tax rate is currently 475.

How to Calculate North Carolina Sales Tax on a Car.

. Division of Motor Vehicles. The information included on this website is to be used only as a guide. Sales tax on purchase of a vehicle.

The Raleigh North Carolina sales tax rate of 725 applies to the following 40 zip. The current total local sales tax rate in Raleigh NC is 7250. The December 2020 total local sales tax rate was also 7250.

It is not intended to cover all provisions of the law or every taxpayers. Sales and Use Tax. Our mailing address is 3101 Mail Service Center Raleigh NC 27699-3101.

The county sales tax rate is. The raleigh north carolina general sales tax rate is 475. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Sales tax on purchase of a vehicle. North Carolina property tax law requires counties to assess the value of motor vehicles registered with the NC. North Carolina has a 475 statewide sales tax rate.

Used 2020 ford ranger xl for sale at leith ford in raleigh nc. Sales tax on purchase of a vehicle. Questions about vehicle property taxes should be directed to the county.

319 mo for 36. For vehicles that are being rented or leased see see taxation of leases and rentals. General Sales and Use Tax.

Technical References for Motor Vehicle Lease and Subscription Tax. NC General Statutes - Chapter 105 Article 5A. The average cumulative sales tax rate in Raleigh North Carolina is 726 with a range that spans from 725 to 75.

In North Carolina it will always be at 3. Physical Location 301 S. Vehicles are also subject to property.

North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. This sales tax is known as the Highway Use Tax and it funds the improvement. North Carolina assesses a 3 percent sales tax on all vehicle purchases according to CarsDirect.

As part of NCDMVs Tag Tax Together program the. Overview of Sales and Use Taxes. All vehicles are nc safety inspected with an available upon request car fax report.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Raleigh North Carolina is.

3 with a max of 475 And IIRC private party used vehicle sales pay the sales tax in AZ too. In addition to taxes. Who Should Register for Sales and Use Tax.

Box 2331 Raleigh NC 27602. This includes the rates on the state county city and special levels. 35 rows Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect.

North Carolina collects a 3 state sales tax rate on the purchase of all vehicles. North Carolina County Tax Offices. What is the sales tax rate in Raleigh North Carolina.

Sales and Use Tax Sales and Use Tax.

Pre Owned Cars For Sale In Raleigh Rdu Auto Sales

Used Cars For Sale Raleigh Nc Durham Cary Used Car Dealership

4700 Westgrove St 408 Raleigh Nc 27606 Redfin

Used 2016 Ford F 450 Xlt For Sale In Raleigh Nc 1fduf4ht8gec58202

20 New Land Rover Cars Suvs In Stock Land Rover Raleigh

Used Suvs In Raleigh Nc For Sale

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

North Carolina Sales Tax Small Business Guide Truic

Big City Auto Sales Inc Auto Dealership In Raleigh

Used Honda Cars For Sale In Raleigh Nc Near Cary Durham

State Our State Magazine North Carolina Digital Collections

Used Subaru Forester For Sale In Raleigh Nc Southern States Subaru

Motor Vehicles Information Tax Department Tax Department North Carolina

Used Bmw For Sale In Raleigh Nc Edmunds

Used Cars For Sale At Johnson Lexus Of Raleigh Used Cars For Sale In Raleigh Nc

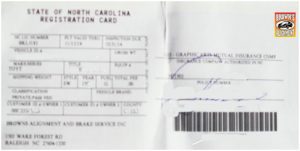

North Carolina State Inspections Brown S Alignment Auto Repair Brown S Alignment Auto Repair